From the trenches (as in a WWI reference) the market is still in a state of gaining down-side momentum.

![]()

What is working in the upward direction?

I: Direct investment in Crypto – though highly volatile it is back to receiving money flows.

Over the past four weeks I have initiated tiny experimental position in three crypto currencies. I have been reviewing the Voyager Digital Crypto site.

- Ethereum (ETH): just made first small buy Aug 18 – up 4%

- Polkadot (DOT): made three small buys starting July 23 – up 81%

- Cardano (ADA): made three small buys starting Aug 14 – up 17%.

I am using dollar-cost-averaging to smooth the volatility. My minimum holding period is projected towards Jan 2022. No reason for this date, other than we had a hard, 50% plus correction and appear to be at the beginning a new upleg, and I want to give the purchases time to run.

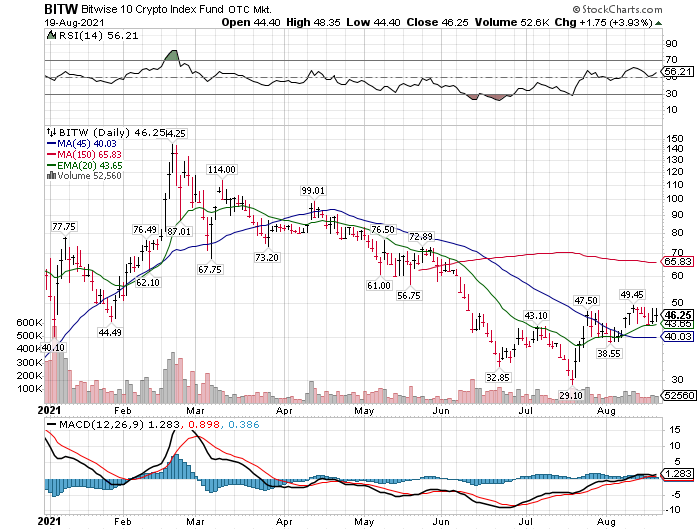

A fund that owns a basket of Crypto currencies, is Bitwise 10 Cryptocurrencies (BITW) $46.25. I do not own it yet but, expect to begin building a position on weakness. What I like about this managed fund is they rebalance each month to own the ten highest market cap cryptocurrencies. In this way you are “current” with the 10 crypto coins that have the most critical mass. The disadvantage is that you are not going to catch the hot story crypto that comes out of nowhere and disrupts the industry.

Technically, this chart is bullish now.

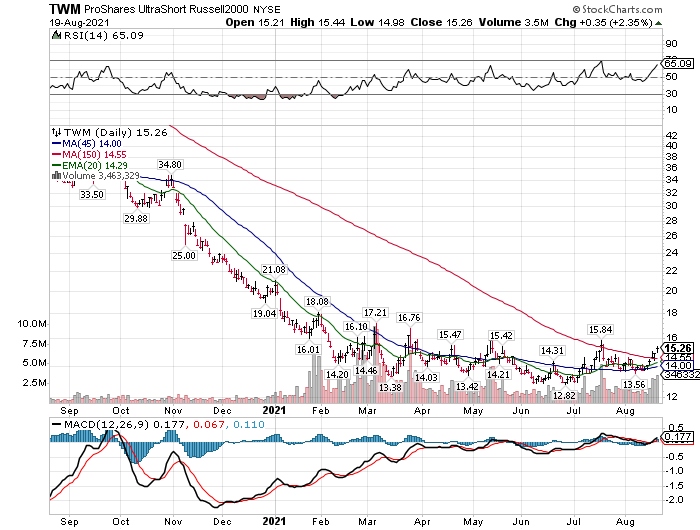

II: Inverse ETF’s

Inverse ETFs are not up significantly, but they are up. Here are charts of two names we have mentioned in LOTM.

Inverse ETFs are now in lift-off position. If the correction get worse, this is an appreciating asset. If the correction does not get worse, a small loss was cheap insurance. Use stop losses. Not two tight and we want to avoid whipsaws.

III: In other activity:

- Precious metal miners are down because of strength in the US dollar.

There is a growing fear of both a slowing economy and rising interest rates sooner than was built into the market. We cant have both at the same time.

Gold miners are incredibly cheap when looked at from valuation and free cash flow generation perspective. Perhaps the cheapest asset class in the market based on P/E ratios and free cash flows. We suggest one continue to accumulate shares in the miners in general, if you like this assets group. This is a counter trend move and not a change in our thesis. Governments around the world are racing to see who can devalue their paper currency the most and fastest. We are confident both precious metals and base metals like Nickel and Uranium will be beneficial to financial buying power and prosperity over the next three to five years. Fait currencies are depreciating. All commodities will benefit from this depreciation.

An excellent interview with George Gammons (linked here) on the perfect out-come desired by the Federal Reserve as it relates to debt solution. In summary, it is what they have said publicly. Keep interest rates low – let inflation run hot. Pay back debt with deflated US$.

Personally, I have lost confidence in the US government’s ability or desire to help its citizens. Hard assets are part of citizen self-protection.

There is a revolution happening in Blockchain and Crypto. Implementation of blockchain technology is happening. Critical mass has been achieved and is showing exponential growth rates.

In DeFi: At the time of writing, users have deposited over $80.7 billion worth of crypto into DeFi smart contracts up from $4.7 billion one year ago today.

https://www.coindesk.com/galaxy-digital-launches-defi-index-tracker-fund

https://cointelegraph.com/news/galaxy-digital-partners-with-bloomberg-for-defi-index

A new Crypto Index has been created for cryptocurrency focused solely on Decentralized Finance (DeFi).

- Galaxy Digital partners with Bloomberg for DeFi index

We are delighted to see Galaxy extending its leadership role in Blockchain & Crypto for institutional Investors. Galaxy is a core holding for LOTM related accounts.

Below are the nine cryptocurrencies in the index. They make up 100% of the index.

Index consisted of the following assets and weightings:

1. UNI Uniswap 40.0%

2. AAVE AAVE 18.0%

3. MKR Maker 12.7%

4. COMP Compound 10.0%

5. YFI Yearn.Finance 5.4%

6. SNX Synthetix 5.0%

7. SUSHI SushiSwap 4.3%

8. ZXR 0x 2.8%

9. UMA UMA 1.8%

If you buy the top 3 crypto’s, you own 70% of the DeFi index.

Accounts related to LOTM own shares of Galaxy Digital (BRPHF) $17.00.

I believe Blockchain and Crypto are part of the solution in both growth and a new financial system. Massive growth is happening now as shown in the example above. People in the blockchain industry like Mike Novogratz of Galaxy Digital, use the phrase, “Blockchain development is not even out of the first half of the first inning” to use a baseball analogy. Clinging to the old as it dies is not going to solve our personal financial situations. Embracing the new is risky but we have to look to the future as it is very obvious the old system is on its way out.

Therefore, accumulating leading companies in Blockchain / crypto as core positions as money is available and managing the volatility through dollar-cost-averaging is my personal path to success. You know who I like in this arena. MKTY* / BRPHF* / COIN & VYGVF*.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()