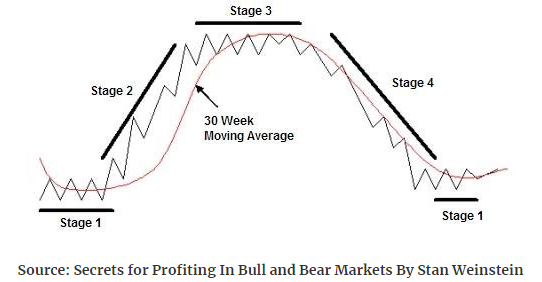

The market rotates between rally phases and correction phases. Normally the rally phase is longer in time while corrections are shorter in duration. This can also be called Risk-on trades and Risk-off trades.

Risk-on trades would include Growth stocks, Crypto, most equity sectors like Bio-tech, Genomis, Semiconductors, and Emerging technologies suce as Cathie Wood’s ARK mutual finces. Risk-off trades would incorporate Precious metals (miners and physical metals) Consumer staples, Value stocks and high quality dividend paying stocks like Utilities and Pipeline companies. Ten-year and shorter Treasuries are also considered Risk-off trades.

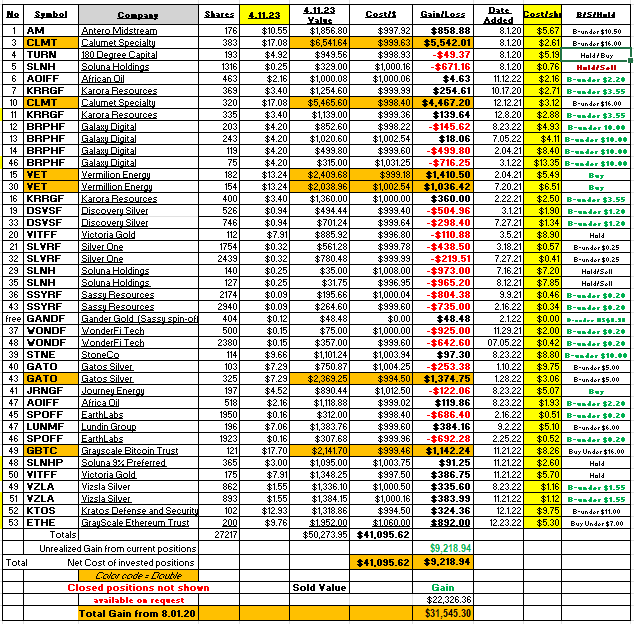

If we select a Risk-off asset like Physical gold or Large Cap Gold miners, we can divide that ETF into any number of Risk-on vehicles (like the NASDAQ 100) and come up with a ratio as to which ETF is outperforming the other. This is important to track as “The Market” is likely to be more volatile and shift from rally to correction phases for shorter periods of time (three to six month cycles) than it has in the past. Each phase can be very volatile in its moves within short time periods. Currently Risk-on is in favor, see chart below, for the NASDAQ 100 and Biotech/Genomic areas, and risk-off in areas, like gold and silver, are out of favor. The ratio above the moving averages is positive for Risk-on vehicles (numerator) and a ratio print below the moving averages is positive to Risk-off vehicles (denominator). Continue reading

![]()