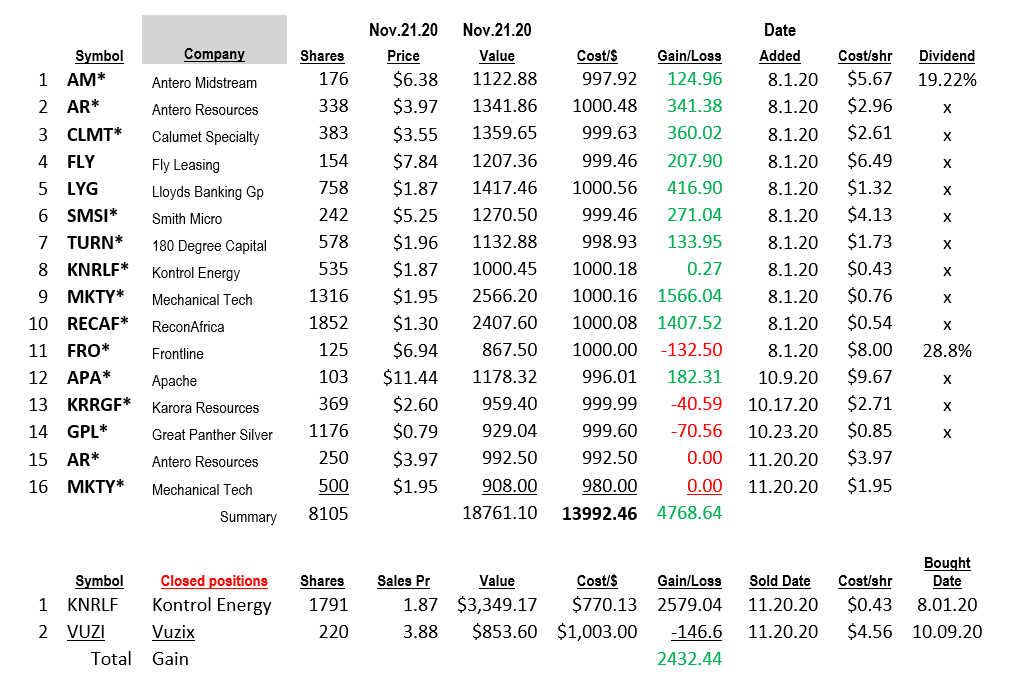

Trimming the Portfolio and Adding to Existing Positions:

We closed out our position in Vuzix (VUZI).

We expected more in revenue and a positive reaction to the Q3 earnings announcement. Revenue was in the $2.7 million area for Q3. We were thinking the company would gain more revenue based on all the activity linked to new clients. Revenue was an increase of 156% year-over-year and up 15% sequentially over our previous record achieved in our second quarter of 2020. It was the comp to Q2 that caused us to wait a bit and the market as well as the shares dropped also. The Good News: VUZI continues to be the industry leader in Augmented Reality ahead of Google, Facebook, Microsoft and Apple. Impressive. We expect to return to VUZI in the future. For now, we would like more of a visible catalyst, and increasing quarter over quarter revenue growth.

We sold the majority of our position in Kontrol Energy (KNRLF).

We reacted slow and left a lot of money on the table. News of a Virus for Covid-19 hit Kontrol Energy hard. We booked a profit of $2,579. We still are retaining 535 shares, which are paid for in the Profit of this partial sale. We like what the company does with retrofitting buildings to make then more energy efficient. The Virus detection device still has excellent sales potential. Kontrol Energy was or first double plus in appreciation.

On a Positive Note:

The Covid virus vaccines have popped the price of two companies we were considering selling – FLY and LYG. We are back on a hold rather than a potential sell with both companies. FLY is a Jet leasing company, and the Vaccine gives time perspective for the Airline industry to recover. LYG is the largest mortgage loan origination company in England. The Vaccine suggest a timeline for workers to firm up their incomes and people’s ability to stay in their home. This is a bit of an edgy topic because we still have six to twelve months before a complete application of the Vaccine is in place.

We added to existing positions of MKTY and AR.

Antero Resources (AR) is doing well. What we hear on fossil energy is that while the demand destruction reduced the need for energy, the destruction on the supply side of energy was even greater. It could take up to two year to bring supplies back on-line and that will not start until oil prices are stable above $50 a barrel. If we say 2.5 years to get supply on-line again, that leaves room for Oil to trade in the $60 to $70 a barrel area. We see more upside ahead to energy stocks. Rather than add another name to the list we made the decision to add to the existing position in AR.

Mechanical Tech (MKTY) produced an outstanding third quarter with $0.16 in earnings per share. We expect an excellent quarter in Q4 of a $0.12 to $0.14 eps. That would put MKTY in the area of $0.30 to $0.35 EPS for 2020. In addition, MKTY is making progress with its Jan 2020, announcement of starting a 100% owned subsidiary dedicated to activity in Blockchain and Crypto Mining. They also, through EcoChain, are an investor in an alternative energy data center, Soluna, dedicated to all things Blockchain and Crypt Mining. As hot as Bitcoin is, and the story of anticipated good prices for Bitcoin for the year ahead, we wanted to increase our exposure to MKTY / EcoChain Mining. Web site www.EcochainMining.com

MKTY is our second double since beginning Aug 1 in creating this list.

This week we also achieved our third double with ReconAfrica (RECAF) $1.30 with a cost $0.54.

ReconAfrica has yet to drill its first well however the extent of its holding is large and leasehold arrangement impressive. RECAF hold the rights to 36,000 square kilometers of property in Namibia and Botswana. They have either 100% or 95% leasehold rights of this property. A secondary offer in the past month opened the publicity door as the catalyst for the price jump. Management team are career pros who are 50ish and coming out of successful retirement to take on this project.

AREAS of Interest we are targeting for 2021 include:

- Gold & Silver miners as number one but all miner will benefit in 2021

- Oil and Gas Industry as a rebound from over-sold conditions

- Bitcoin and Crypto currencies.

- Cyclicals, especially those impacted negatively buy Covid-19.

- Small Cap Growth

- Commodity companies as beneficiaries of Federal Reserve targeting higher inflation.

- Dividend stock in the above areas.

Subscribe to our Free LOTM Weekly Summary at www.LivingOffTheMarket.com

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()