SUMMARY:

- Physical Silver broke to the downside last week.

- Fundamental outlook for silver is excellent.

- Silver Miners corrected an exaggerated amount Vs Physical Silver

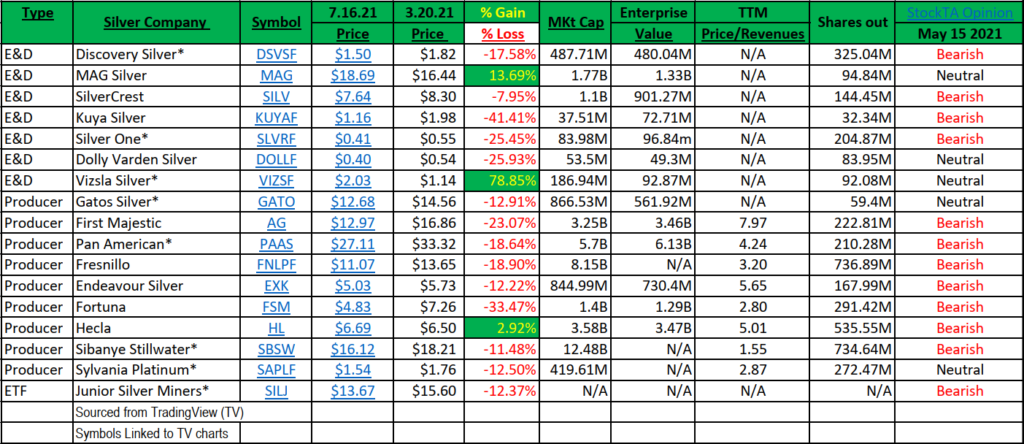

- Here is our tracking list of Silver companies:

NOTE ON TECHNICALS ABOVE: LOTM believes the group is oversold with excellent fundamentals.

The silver mining industry is very volatile and a much more dramatic price mover than physical silver. We think it has been overdone. Technically we believe the silver miners are extended on the downside and set up for a trading rally.

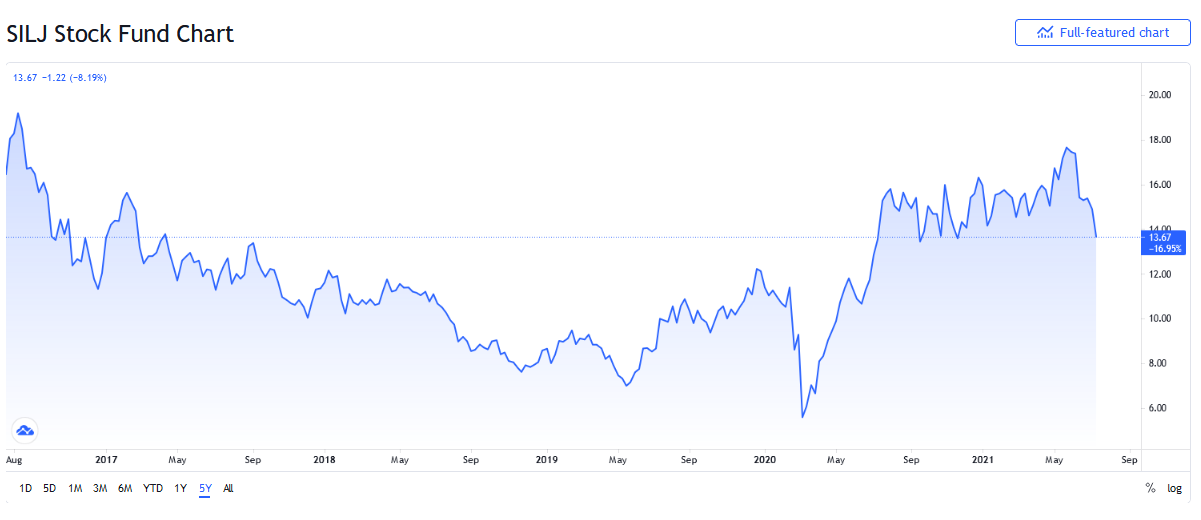

We would be a buyer of SILJ, the Junior Silver Mining ETF for a trade. It’s not as dramatic a mover as an individual stock, but easy to buy and sell for liquidity and more conservative if I am wrong.

Below are the one year chart from TC2000 and the five year chart from TradingView.

For both charts we are approaching major support areas.

For the one year chart above, we believe we are extended below support and the price can rebound back towards resistance at its 50 and 150-day moving averages – now above the price. See Above.

For the five year chart we are projecting support at the right hand edge of the breakout (June 2020) of the three year basing pattern that started in 2017.

We see no evidence for a fundamental change in our bullish outlook for silver. Supply is shrinking, and demand is growing. The move to “all electric” driven by globalist governments, is loaded with problems. One problem is finding the materials needed to do the build out. Copper, Nickel, Silver & Lithium are all needed and are going to be hard to source and more expensive.

Silver is probably the shortest in supply of the group and the cheapest of any mineral in the world at this time. Supply shortages are one of the BEST ways to make money in the equities and commodities market.

Individual Names in Silver:

It is hard to pick one name and say it is “the one” to buy. We strongly suggest buying a group of five silver miners. Perhaps three producers and two exploration companies. You could reverse that and buy three exploration companies and two production companies. Producers will move first but exploration companies will rally more. Silver miners are one of the most volatile sectors in the market. That is why we suggest five or even more and treat them as one play. It is very random trying to pick the one that will move first, fastest, or highest. The probability is very high, that you can make money from the industry when buying silver miners, especially when using a dollar-cost-averaging risk management tactic and buying as a package.

Please keep in mind that 1) this is a very healthy industry at this time, 2) highly unlikely the companies above will go out of business, this is the decade of inflation and rising commodity prices. We know this because 3) the Federal Reserve and Treasury Department is telling us they want inflation and low interest rates.

The probabilities are overwhelmingly on your side. (Rick Rule, formerly President Sprott Inc.)

We are available for coaching or training.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

430 total views, 2 views today